As a farmer, you face many risks. Some of the worst are climate change and its effects. Prolonged drought, unreliable rainfall or floods can wipe your crops or livestock in a day. Other general threats include theft and fire that can destroy your premises and farm machines. luckily, there are various agriculture insurance companies that insure farmers, ranchers and business people in Kenya.

The insurable risks facing farmers, herders, ranchers, and agribusinesses in Kenya primarily revolve around climate-related challenges, particularly drought

The products include crops and livestock insurance against the above risks. In some counties, you can enjoy a subsidy under the Kenya livestock insurance program (KLIP) or the Kenya National Agricultural Insurance Program, and pay cheap premiums from underwriters.

Agriculture Insurance Companies in Kenya

Are you wondering where you can insure your crops or animals in Kenya?

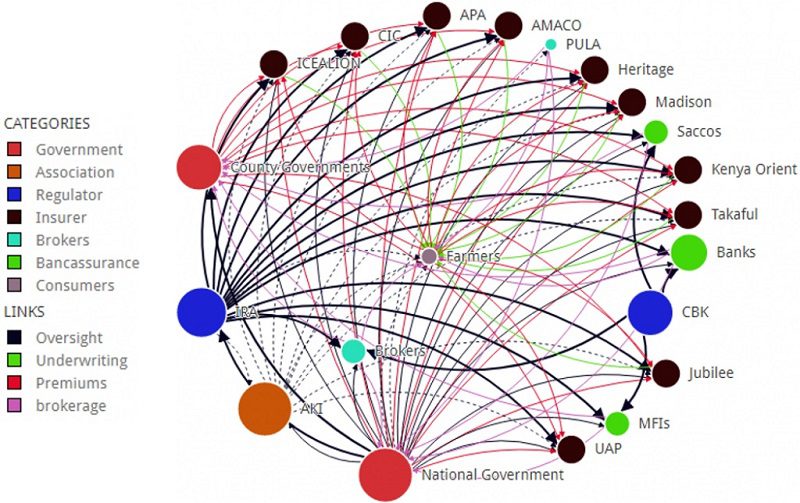

There is diversity in the sector with insurance companies taking the lead. There are are a few banks and Saccos which offer bancassurance services. Besides these there are the associations, regulatoes and brokers who make the sector thriving.

We explain these in details below

Insurance Regulatory Authority (IRA)

The IRA regulates the insurance industry. It is a statutory agency established under the Insurance Act 2006 or CAP 487 of laws of Kenya. Its role is to regulate, supervise and develop the sector.

Banks, MFIs or Saccos broke and sell insurance products alongside banking. The Central Bank of Kenya (CBK) regulates the banking and financial sector in the country.

Their role is awareness creation, oversight and regulation of the sector.

The Association of Kenya Insurers (AKI)

AKI is a voluntary membership and non-profit advisory association body for the insurers. Its role is the self-regulation of the sector and its development. It helps in lobbying for a better business environment the country. Besides the association helps in awareness creation, oversight and regulation of the sector.

Insurance companies in Kenya

There are 58 insurers and reinsurers in Kenya. Though not all of them offer agriculture insurance. The list below has 10 registered insurance companies in the region which cover various agriculture risks. They are

- APA Insurance Company

- CIC General Insurance Company;

- Kenya Orient Insurance Company

- ICEALION General Insurance Company

- UAP General Insurance Company

- Jubilee Insurance Company

- Heritage Insurance Company

- Madison Insurance Company

- African Merchant Assurance Co. Ltd.

- Takaful Insurance of Africa Limited

Brokers

Besides the major players, there are various service players involved in the agriculture insurance. These include;

Brokers who give agency services on behalf of underwriters. They will facilitate you to search and identify the products for your crops or livestock. In the case of compensation, they may help in the claiming process.

Others like PULA offer disruptive solutions for the sector. It provides farmers with insurance bundled with other inputs such as seeds and fertilizers. Besides, they give you the advice to increase yields and income.

Conclusion

We hope this article has helped you to understand the agriculture insurance landscape in Kenya. As a commercial farmer, do not suffer losses from your farm any longer. Take a crop or livestock insurance today. To do it, search for a product that is suitable for you. Settle on a reliable insurer and negotiate for an affordable premium.

Thanks for publishing this great page without doubts is very good