In this blog, you will learn about the various sources of agriculture finance available in Kenya in 2025, how to access them, and practical tips to choose the best funding options for your farm or agribusiness.

Are you a youth or woman farmer in Kenya looking for funding? Whether you’re a farmer, herder, food processor, or input trader, access to affordable capital is often the biggest barrier to growing your agribusiness. From moving into greenhouse farming to expanding your dairy herd, reliable financing can make all the difference.

The good news? Kenya’s agriculture finance landscape is rapidly changing. Innovative, tailored, and tech-driven solutions are replacing old restrictive lending models, opening new doors and helping farmers access the right funds at the right time to grow and succeed.

Understanding Agriculture Finance challenges in Kenya

Agricultural finance differs fundamentally from general business lending due to the unique rhythms and risks of farming:

- The Challenge of Seasonal Cash Flow: Unlike retail businesses with consistent monthly revenue, agricultural enterprises experience seasonal cash flow patterns and poor record keeping. Income is concentrated around harvest periods, followed by extended investment phases (planting, tending). Structuring your financing to align with these natural cycles is crucial, ensuring repayment schedules match when your cash actually comes in.

- Leveraging Asset-Based Security: For most agricultural lending, asset-based security forms the backbone. Assets such as land, equipment, livestock, and even future crop yields can serve as collateral. Critically, agricultural assets often appreciate over time, making them increasingly valuable as your operation matures.

Majority of Modern agricultural lenders have shifted their approach on how they evaluate borrowers. They increasingly utilize sophisticated technology, including:

- Satellite data and remote sensing.

- Weather patterns and soil quality assessments.

- Market price trends.

With this shift, as a farmer who embrace transparent record-keeping and data-driven farming practices you can access better financing terms than those relying solely on traditional relationship-based lending.

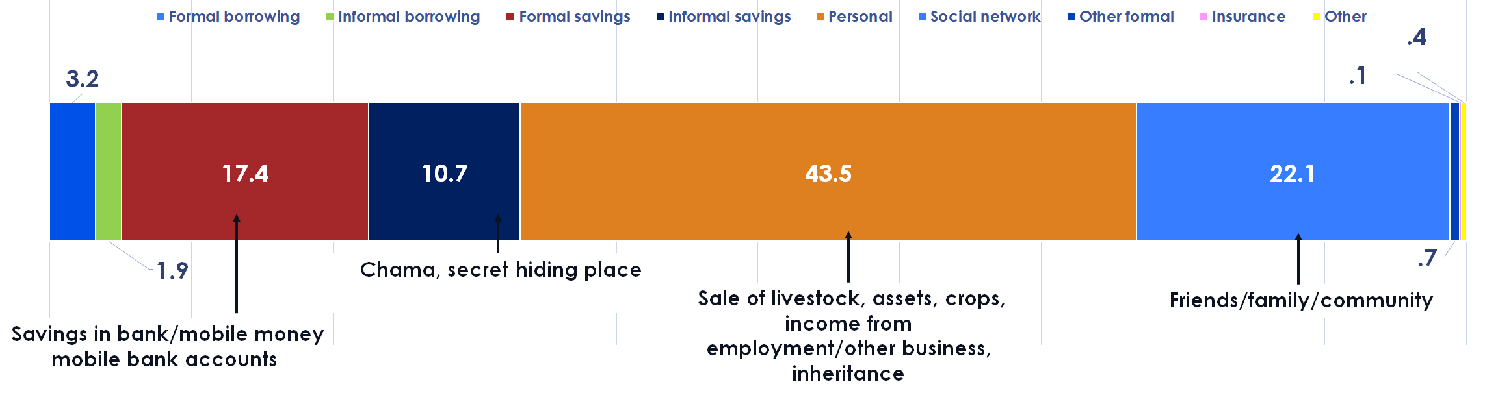

Best Agriculture Finance Options in Kenya

In this comprehensive guide, you wil explore every viable agrifinan c path to securing funds for your farm in Kenya. From personal savings and government subsidies to cutting-edge digital platforms It will help you to ensure you choose the right agriculture finance mix aligned with your specific growth objectives, risk profile, and needs.

| Your Need | Best Source(s) | Key Things to Check |

| Small, short-term input purchase | Personal savings / informal savings / SACCO / fintech platforms | Cost (interest/fees), repayment period, flexibility |

| Medium-term asset purchase (e.g., tractor, drip system) | AFC / bank asset loan / equipment leasing / SACCO loans | Collateral, down payment, depreciation, maintenance costs |

| Scaling for market access & exports | Contract farming / value chain financing / grants / venture capital | Buyer reliability, contract terms, risk sharing |

| Covering seasonal risk (drought, flood) | Insurance + emergency saving reserves / government subsidies | Premium subsidies, payout trigger clarity, coverage limits |

Personal Savings

Personal savings are best used for startup expenses in agriculture Finance such as registering your business, buying land, or purchasing initial inputs like seeds and fertilizers. There are 2 simple ways you can grow your savings for your agribusiness idea.

Informal Savings

Your best choice is to save personally or through a village-based groups, chamaas, or merry-go-rounds to save small amounts rotationally, where your money can earn interest and dividends sharable annually.

Formal Savings

A better option is to operate a savings account with a financial institution such as as commercial bank, SACCOs, MFI or opt for a mobile money account, or a money market fund with an insurance company.

- Bank, SACCOs, or MFI Accounts: These offer easy access for operational needs.

- Money Market Funds: These funds, often offered through insurance companies, typically provide 6–8% returns, making them ideal for long-term project funding requiring longer commitment periods.

The advantage is that your principal will earn interest or dividends over time.

Digital Savings

A Mobile Money savings Accounts with Platforms like M-Shwari and KCB M-Pesa offer accessible micro-savings opportunities with competitive interest rates.

Other agriculture-specific apps like Agriwallet or Vermi Farm Initiative provide farming savings accounts with features specifically designed around seasonal cash flows, helping you set money aside systematically.

Retained Profits

Farm and business profits, often referred to as retained earnings, are the most cost-effective source of agriculture finance. Because these funds come from your own operations, they don’t carry the burden of interest payments or repayment pressures like external loans do. However, it’s important to approach profit reinvestment strategically rather than channeling all your earnings back into the business at once.

Related How to Calculate Your Farm Profits

A proven method for sustainable growth is to allocate profits using a balanced framework adapted for agriculture. One effective guideline is the 70-20-10 rule.

Related; How to Keep Farm Records Better

- 70% funds current operations and mandatory reinvestments.

- 20% targets growth investments that expand capacity or improve efficiency (e.g., drip irrigation, new equipment).

- 10% goes into emergency reserves for market or weather-related challenges.

Government Support

Read More: How to Access Government’s Agriculture Financing aid in Kenya

The national and county governments are a leading source of agriculture finance in form of cheap loans and free funding for Kenyan farmers, working through affirmative loans, subsidies, and specialized lending via the Agricultural Finance Corporation (AFC)

The Agricultural Finance Corporation (AFC) Loans

The Agricultural Finance Corporation (AFC) is Kenya’s most comprehensive source of specialized agricultural lending. AFC loan rates are typically 2–3% below commercial bank rates.

Key AFC Loan Products include:

- Seasonal Crop Credit: For production and harvest costs for crops like maize and rice.

- Cash Crop Loans: For commercial operations like coffee, sugarcane, and tea.

- Asset Finance Loans: Supports the acquisition of assets, vehicles, and machinery, often with terms up to seven years.

- Agribusiness Products: Provides working and startup capital for value-addition, trading, processing, and transportation.

- Greenhouse Financing and Modernization Loans.

Application Success Strategy: AFC prioritizes borrowers who submit a comprehensive business case with clear financial projections, detailed market research, technical specifications, and letters of intent from potential buyers.

Government Subsidy Programs

Government subsidies reduce input costs and risks, acting as an indirect source of funding.

- Input Subsidies: The fertilizer subsidy program significantly reduces input costs by approximately 30%. To access this benefit, farmers must be registered with the Ministry of Agriculture.

- Insurance Subsidies: The government heavily subsidizes crop and livestock insurance premiums to encourage adoption among smallholder farmers, though adoption is still below 15%. Utilizing subsidized insurance allows farmers to invest more aggressively, knowing their downside risk is mitigated.

Affirmative Action loans

These loans are supported by government programs to promote inclusivity, especially for women and youth who historically faced disadvantages.

Youth Enterprise Development Fund (YEDF): Offers credit up to KSh 500,000 at an attractive 8% annual interest rate for entrepreneurs under 35. Success often relies on forming groups based on complementary skills and mutual accountability.

Women Enterprise Fund (WEF): Provides opportunities and technical support for female entrepreneurs, often focusing on value-addition activities.

Other affirmative funds include the Uwezo Fund and the Hustler Fund, as well as county government initiatives like the Laikipia County Revolving Fund (LCRF), and the Makueni County Tetheka Fund.

Traditional Borrowing

Informal borrowing

Sometimes the fastest and cheapest way to get agriculture finance is through people you already know and trust.

- Chamaas: By joining a local savings group, you and other farmers contribute money regularly and borrow when needed. This makes it easier to access quick loans for seeds, fertilizer, or small tools.

- Family and Friends: Borrowing from relatives or close friends is common. It’s usually flexible, low cost, and based on trust—helping you cover urgent farm needs without heavy interest charges.

Farmer’s Note: Use informal borrowing mainly for small or emergency needs. For bigger projects, start building towards SACCOs, AFC loans, or digital credit so your farm can grow sustainably.

Formal credit, though sometimes considered restrictive and expensive, provides the necessary scale for commercial expansion. Kenya has 39 licensed commercial banks and 14 licensed Microfinance Institutions (MFIs), plus 176 deposit-taking cooperatives regulated by the Central Bank of Kenya (CBK) and SASRA.

Commercial Bank Loans

Commercial banks like Equity Bank, KCB Bank, and Cooperative Bank of Kenya offer specialized agricultural loans.

Key bank Loan Products include Seasonal Crop Credit, Cash Crop Loans, Asset Finance Loans, specialized Dairy Farming Loans (often with insurance coverage), and Farm Animal Loans (covering poultry, goats, fish farming, etc.).

Banks increasingly use relationship scoring alongside traditional credit scoring. Farmers must build strong relationships by maintaining consistent account activity, transparent financial records, and engaging proactively with their relationship manager.

Microfinance Institutions (MFIs)

MFIs target underserved populations and smallholder farmers. Specialized MFIs, like Juhudi Kilimo and Faulu Bank or BIMAS offer products ranging from small KSh 10,000 input loans to KSh 500,000 equipment financing. The advantage of these institutions is their specialization in agriculture and their willingness to accept agricultural assets as collateral.

SACCOs

SACCOs (Savings and Credit Co-operative Societies) are member-owned institutions that provide an accessible path to formal credit. Agricultural SACCOs, such as Dhabiti Sacco, Times U, and Universal Traders Sacco, play a significant role in providing loans for farm expenses.

Regular savings contributions and active participation in governance build your equity and borrowing capacity over time.

Digital Financial Services

Kenya is a leading fintech hub with over 500 mobile money apps and loans. The digital revolution is transforming access to agricultural credit by bypassing traditional lending requirements.

If you have a phone, you already carry a bank in your pocket. Mobile money has changed how farmers in Kenya save, borrow, and pay. And now, new digital tools are going even further to help you access farm loans and secure your markets.

Mobile Money Agricultural Lending

We’ve moved beyond simple apps like M-Pesa and Tala. Today, agriculture-specific platforms are designed just for farmers:

- Apollo Agriculture, Agriwallet, Mkopa, and Twiga Foods don’t just lend you money. They give you inputs, link you to buyers, and even insure your crops.

- Instead of asking for land title deeds, they use satellite maps, weather data, and soil tests to decide your loan limit. That means even smallholders with no collateral can qualify.

- With Apollo, for example, farmers have seen up to 45% higher yields, and the guarantee of a ready buyer means no more struggling to sell after harvest.

Advanced Digital Concepts

The digital wave is still rising, and new tools are on the horizon:

- Blockchain finance records your farm activities in a secure way. Soon, this could allow you to use your harvest data as collateral, instead of relying only on land or livestock.

- Cryptocurrency payments are also being tested for farming. They can be fast and sometimes cheaper, but they are risky—prices change quickly, and Kenya’s laws are still catching up. Only use them if you understand the risks and work with trusted partners.

Community-Based Financing

Sometimes the easiest place to find agrifinance for your projects is right in your community. These options rely on trust, shared savings, and mutual support, making them flexible and affordable for farmers.

- Farmer Groups: By joining producer or marketing groups, farmers pool resources and lend to each other. Members can borrow for seeds, fertilizer, or small equipment, while also enjoying stronger bargaining power when selling produce.

- Community-Based Organizations (CBOs): Local organizations that support farmers with affordable loans and sometimes training. Because they’re rooted in the community, they understand farmers’ needs and offer more flexible repayment terms than banks.

- Cooperatives: Farmers save and borrow together under a formal structure. Cooperatives often provide larger, cheaper loans compared to informal borrowing. A strong example is the Githunguri Dairy Cooperative, which has grown big enough to start its own SACCO, giving members access to wider financial services.

Farmer’s Tip: These options work best when you save consistently and stay active in your group. The more committed the members, the stronger the financing support for everyone.

Development Grants and Donations

Read More: A list of the Best Agriculture NGOs in Kenya

Beyond banks and cooperatives, you can also benefit from support from development partners. These organizations work with farmers, communities, and government to strengthen agriculture through funding, training, and resources. Their support often comes as loans, grants, or donations aimed at boosting productivity and sustainability.

- Faith-Based Organizations (FBOs): Rooted in religious communities, FBOs provide loans, grants, and farm resources. They also strengthen community bonds by encouraging collaboration. Many churches and faith groups in Kenya run agricultural support programs.

- Non-Governmental Organizations (NGOs): NGOs are among the most active supporters of farmers. They offer training, inputs, and financing tailored to farmer needs. Leading NGOs in Kenya include Mercy Corps, Heifer International, One Acre Fund, AGRA, WFP, and FAO.

- International Donors: Global partners fund large-scale agricultural projects across Africa, including Kenya. They provide money, technical support, and resources to improve productivity and resilience. Examples include the Bill & Melinda Gates Foundation, USAID, FCDO, BMZ, and GIZ.

- Foundations: CSR Donors in Kenya and regional foundations play a big role in farmer support through grants and affordable loans. Well-known ones in Kenya include the KCB Foundation, Equity Bank Foundation, and Mastercard Foundation.

Farmer’s Tip: Development partners often channel their support through groups, cooperatives, or projects. To benefit, join active farmer groups and stay informed about programs running in your county.

Alternative Financing methods

Agriculture finance is undergoing a modern revolution, embracing models that link financing directly to production and market potential such methods include;

Value Chain Financing

This contemporary approach links agrifinancing to the entire production and marketing chain.

- Contract Farming: Farmers enter agreements with buyers (like horticultural exporters or processors) who provide advance financial support, technical assistance, and guaranteed purchase of produce in exchange for supplying a specified amount. This model ensures stable income and technical support alongside financing.

- Supply Chain Integration: Financing can occur at multiple points—input suppliers offering credit terms, processors providing advance payments, and retailers offering inventory financing.

Crowdfunding and Venture Capital

- Invoice Financing: This allows agribusinesses to use unpaid invoices (from committed buyers) as collateral to secure immediate funds, providing instant cash flow for operations..

- Crowdfunding: Platforms allow farmers to raise capital for specific projects by engaging a broader online audience. Success requires strong storytelling and clear communication with potential funders.

- Venture Capital (VC): VC firms invest in innovative agribusinesses with unique technologies or approaches, injecting significant funds to foster scalability and modernization.

How to Build Your Agriculture Finance Portfolio in Kenya

The most successful agricultural enterprises do not rely on a single lender; they employ a Multi-Source Financing Strategy.

A strategically optimized financing structure might look like this:

- Personal Savings: For operational flexibility and small emergency reserves.

- AFC/SACCOs: For affordable, tailored loans for seasonal inputs.

- Commercial Bank: For large, long-term Asset Finance Loans (e.g., equipment).

- Contract Farming/Digital Platforms: For guaranteed input financing and market access.

- Insurance (Subsidized): For critical risk management protection.

- Coordination and Timing

Strategic farmers develop financing calendars to coordinate the diverse application timelines, disbursement schedules, and repayment requirements of different sources. Furthermore, effective financial planning requires cash flow management integration to ensure loan structures align with seasonal production cycles.

You must apply Portfolio Risk Management principles. Diversifying agricultural enterprises reduces overall risk, making you more attractive to potential lenders. Maintaining transparent Financial Monitoring Systems and providing regular performance updates builds lender confidence, often leading to better terms on future financing.

Conclusion

Kenya’s agriculture finance landscape offers unprecedented opportunities. The convergence of traditional specialized lenders like the AFC, robust government support, and radical digital innovation creates multiple accessible pathways to capital that simply did not exist a decade ago.

Your success hinges not just on your skills in growing crops or raising livestock, but on your ability to master the art and science of agricultural finance. The most successful farmers are strategic: they build relationships, maintain transparent records, invest in business planning, and utilize a multi-source financing portfolio.

(Disclaimer: Agriculture finance products, interest rates, and program requirements change frequently. Always verify current terms and conditions directly with financial institutions before making financing decisions.)

I would like to grow beans and I have no capital to start the farm work